Financial Literacy for Teenagers

How to teach teenagers the value of money

Key Takeaways

- Inspire them to imagine their future prosperity by creating a vision board.

- Explore opportunities to earn money through part-time jobs or side hustles.

- Encourage them to budget by the 50-30-20 rule for needs, wants and savings.

- Demonstrate the significance of compound interest and investment by utilizing Savings Accounts or engaging in virtual stock trading

- Foster their compassion and generosity by motivating them to contribute their time, money, or resources to help others.

As parents, we are tasked with preparing our children for adulthood, and financial literacy plays a pivotal role in this journey. When it comes to teaching teenagers about money, it is about letting them take lead and learn from their mistakes. Empower them to envision prosperity, earn money, and budget effectively. Additionally, educate them on the power of compound interest and investing. Finally, instill in them the joy of giving by nurturing empathy and generosity. These will not only prepare our teen kids for financial success but also for a well-rounded, compassionate, and confident adulthood.

Explore Approaches to Teach Teens about Money

As parents, we often approach our child’s teenage years with either excitement or apprehension. Regardless of our sentiments, our ultimate objective remains consistent: to prepare them for independent adulthood, enabling them to become successful contributors to society while adeptly navigating life’s challenges. As our children navigate the path toward independence, financial literacy becomes a powerful tool that equips them to make informed decisions, set goals, and build a secure financial future.

Teenagers can be likened to apprentice adults in training. As parents, it’s our responsibility to equip them for the day they step into college or begin independent living in an apartment with friends. The good news is, we don’t need to be financial experts to educate teens about money. It’s about providing guidance and allowing them to take the reins. As your children enter their teenage years, encourage them to take charge of their financial choices. Give them room to make mistakes while offering guidance. Bring concepts they’ve learned, like delayed gratification, budgeting, and distinguishing needs from wants, to life by discussing them in practical situations and providing valuable education along the way.

In this blog post, we’ll explore the importance of teaching teenagers about money, discuss key concepts to cover, and provide practical tips for parents and educators to engage and empower this dynamic age group.

Teach Teenagers about Money by Helping them Envision Prosperity

Have you ever pondered what prosperity truly means to you? Now, have you considered what it means to your 15-year-old? Engage in an open and transparent conversation with your teenager about money and prosperity, asking, “What does prosperity mean to you?” Encourage them to think beyond boundaries by exploring questions like, “What would you do if you had a million dollars?” This conversation can be an eye-opener.

To take this exploration further, consider incorporating a vision board activity. Together, create a visual representation of their aspirations. This exercise can help them understand and document both short-term financial goals, such as buying new shoes or tickets to a concert, and long-term financial goals, like achieving a debt-free college experience or embarking on a memorable vacation with friends at eighteen.

Encouraging your teenager to visualize their dreams and desires can be a powerful motivator for financial responsibility and a great tool in teaching teenagers about money. It not only instills the concept of setting goals but also reinforces the idea that prosperity is a personal journey, with both short-term pleasures and long-term achievements to strive for.

Encourage Your Teenage Kid to Earn Money

As your child rapidly matures and acquires new skills, it’s the perfect opportunity to reassess their allowance system. A great way to recalibrate their allowance and teach teenagers about money is to associate their allowance to more intensive activities or chores such as lawn maintenance or clearing the driveway of snow etc. By redefining the chore list and the corresponding allowance, you not only acknowledge their growing capabilities but also help them establish a direct correlation between hard work and income. You can use our budget planner for teens to establish and track their allowance and earnings.

Beyond their allowance at home, it’s a great time to encourage your teenage child to explore part-time jobs or side hustles. While they may not yet have access to traditional employment opportunities, guiding them to identify their unique skills and seek appropriate roles can be highly beneficial. Encouraging teens to explore these opportunities not only exposes them to the working world but also nurtures their interests and passions. Whether it’s taking up responsibilities like babysitting, dog walking, or even venturing into small online businesses, these experiences can ignite their entrepreneurial spirit and boost their self-confidence. For those demonstrating entrepreneurial flair, the idea of starting a side business can be particularly appealing, providing them with insights into market dynamics, customer service, and the principles of running a business.

These endeavors not only offer teenagers extra cash but also contribute to their personal growth and help build a positive relationship with money. They learn essential life skills such as teamwork, time management, and responsibility. Moreover, witnessing deductions for taxes on their paychecks provides a valuable lesson in managing their hard-earned money—a skill that will serve them well throughout their lives.

Teaching Teenagers about Money through Budgeting

One of the most valuable lessons you can teach your teenager is effective money management, and at the heart of this financial journey lies budgeting. Budgeting isn’t just about balancing the books; it’s about instilling financial discipline, prioritizing needs over wants, and working towards both short-term and long-term financial goals. Here’s how you can guide your teenager through this essential skill.

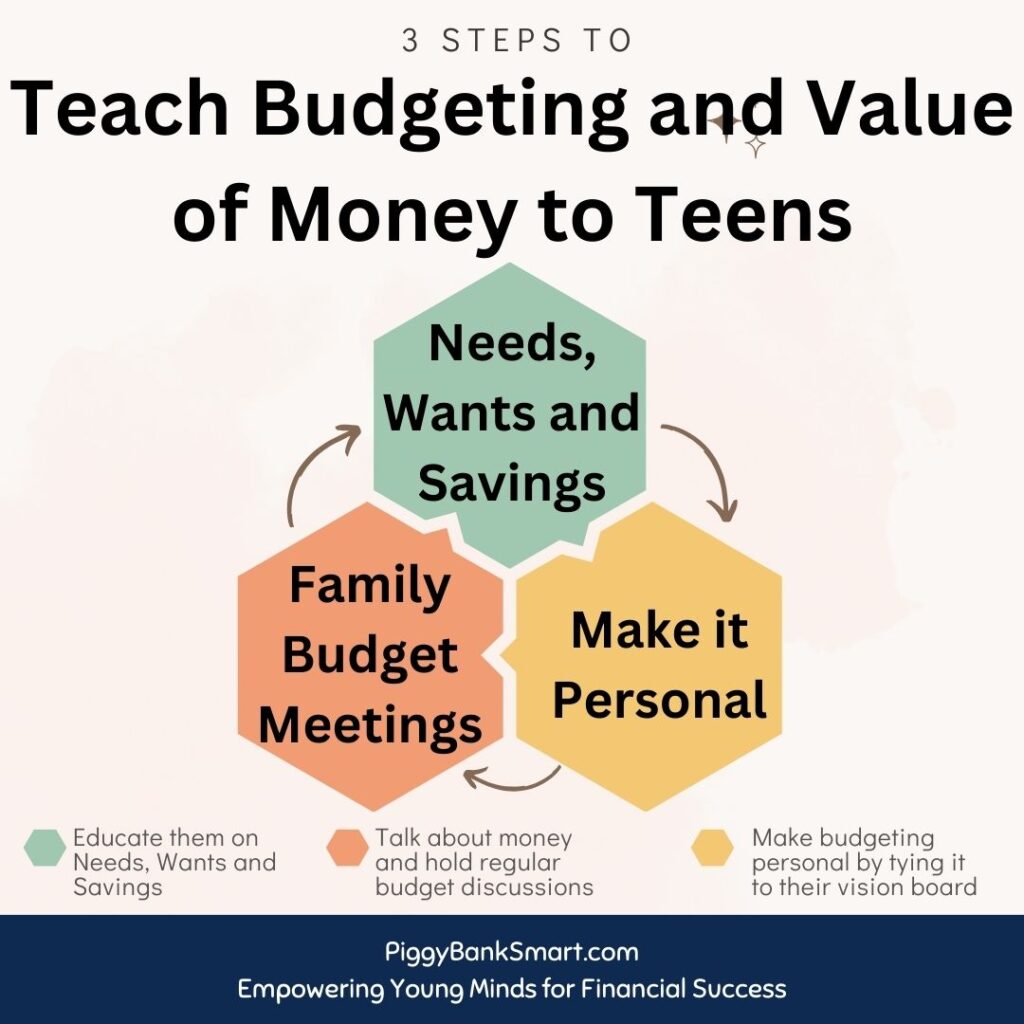

Understanding Needs, Wants, and Savings:

By this age, hopefully your kids already understand the concept of needs (things that are essentials), and wants (extra items/ experiences that they wish for). Emphasize the importance of prioritizing needs over wants when allocating their budget. Also prioritize saving and charity as part of their budgeting approach.

For teenagers, an appropriate budgeting ratio could be 40:20:40—40% of their budget allocated for needs, 20% for wants, and 40% for savings and charity. This ensures that a significant portion of their income is dedicated to savings, setting the stage for future financial security.

Incorporate family budget meetings to teach your teen kids about money

Initiate your teenager into the realm of budgeting through family budget meetings. Gather as a family on a regular basis, ideally before each new month commences, to craft a budget together. During these gatherings, you’ll have the opportunity to teach your teen essential skills like financial planning, fund allocation, and informed decision-making.

The essence here lies in repetition. Transform this into a cherished family tradition, especially during the initial stages. Sit alongside your teenager, guiding them through the budgeting process for a few months. With time, as they grow in confidence and accumulate experience, you’ll find these sessions become more efficient, and you may be pleasantly surprised by their burgeoning financial acumen.

Tying it all to their personal vision board

Connect budgeting to their aspirations and goals. Remember that vision board you created together? Their short-term and long-term financial objectives should align with that vision. Ask questions like, “What do you want to achieve in the next six months or year?” This could be buying a new gadget, saving for a trip with friends, or even starting a small business.

Track these goals through budgeting. Allocate a portion of their savings toward these objectives and monitor their progress. This not only reinforces the value of budgeting but also provides tangible results, showing them that responsible financial management brings them closer to achieving their dreams.

Teaching your teenager to budget is a valuable gift that will serve them throughout their life. It instills financial responsibility, encourages smart spending, and empowers them to turn their dreams into achievable goals. By making budgeting a family practice, you’re creating a strong foundation for financial success and helping your teen navigate the exciting world of money with confidence.

Teaching Teenagers about Money: Power of Compound Interest and Investing

In your quest to equip your teenager with essential financial knowledge, don’t overlook the significance of educating teenagers on complex yet vital money concepts like compound interest and investing. These concepts have the potential to lay the foundation for a secure financial future and prosperity and are a critical aspect of teaching teenagers about money.

Compound Interest: The Power of Time

Begin by unraveling the magic of compound interest. Explain that it’s not just about the interest earned on an initial investment but also the interest earned on the interest itself. This means that the earlier they start saving and investing, the more time their money has to grow.

You can use simple examples to illustrate the point. Show them how investing a certain amount regularly over time can exponentially increase their wealth. This eye-opener not only underscores the importance of early investing but also the value of patience and consistency.

Investing: Path to Financial Prosperity

Introduce your teen to the world of investing, emphasizing that it’s not reserved for the wealthy or the experts. You can start by discussing the different investment options available, such as stocks, bonds, mutual funds, and real estate. Explain the potential risks and rewards associated with each.

To make it tangible, consider guiding your teen through a hypothetical investment scenario. Suppose they have a sum of money and are considering investing it in stocks. Discuss how they would research companies, assess their financial health, and make informed investment choices. You can also highlight the concept of diversification to manage risk effectively. You can also have them practice stock trading with virtual money through tools like Virtual Stock Market Simulator by Investopedia

Long-term vision and goals

Encourage your teenager to adopt a long-term perspective when it comes to investing. Emphasize that investing isn’t about getting rich quickly but rather building wealth steadily over time. Share stories of successful investors who started early and reaped the benefits of their patience and smart choices.

Relate investing to their vision board and financial goals. Help them understand that investing can be a powerful tool to achieve those goals, whether it’s funding their dream college education, buying a home, or embarking on an exciting adventure.

Risk and the need for responsible investing

Teach your teen that while investing offers opportunities for growth, it also involves risk. It’s important to stress the importance of making informed decisions and never investing more than they can afford to lose. Encourage them to research, seek advice, and continually educate themselves about the investment world.

By educating your teenager on compound interest and investing, you’re arming them with the knowledge and tools needed to make wise financial decisions. These concepts are not just about growing wealth but also about instilling financial responsibility, patience, and a forward-thinking mindset. As they embark on their financial journey, they’ll be better prepared to navigate the complexities of the financial world and work toward achieving their dreams.

Teenagers and Joy of Giving: Fostering Empathy and Generosity

No one has ever become poor by giving.

Anne Frank

Teaching teenagers about money is not only about helping them understand and manage their money and financial future, it is also about instilling values like empathy and generosity. Encouraging your teenager to explore the “Joy of Giving” can be a transformative experience for them and for the communities they touch.

Empathy through experiences:

Start by nurturing empathy within your teenager. Help them understand that not everyone is as fortunate as they are. Engage in conversations about societal issues, both locally and globally. Encourage them to ask questions and seek answers about the challenges faced by others.

One way to foster empathy is through volunteering. Encourage your teen to get involved in community service or charitable organizations. Whether it’s helping at a local food bank, participating in a clean-up drive, or volunteering at a shelter, these experiences expose teenagers to the realities faced by those less fortunate and help them develop compassion.

Teaching the art of giving:

Explain to your teenager that giving isn’t limited to monetary donations. It can also involve donating time, skills, or resources. Sit down together and discuss causes that resonate with them. Whether it’s supporting a children’s hospital, aiding disaster relief efforts, or promoting environmental conservation, let them choose a cause they are passionate about.

Once they’ve identified a cause, work together on creating a giving plan. This plan can include allocating a portion of their allowance or earnings towards donations, organizing fundraising events, or simply volunteering their time regularly. By actively involving them in the decision-making process, you empower them to take ownership of their giving journey.

Understanding the ripple effect of their contributions

Highlight the impact of their contributions. Show them how a small act of kindness can create a ripple effect, benefiting not only the recipients but also themselves. Share stories of individuals or organizations that have made a difference through their charitable endeavors.

Build a Culture of Giving

Make giving a family affair. Consider setting aside time for family volunteering activities or charitable outings. Engage in discussions about the causes your family supports and why they are important. By creating a culture of giving within your family, you reinforce the value of generosity and compassion.

Reflecting on the experience

Encourage your teenager to reflect on their giving experiences. How did it make them feel? What did they learn? What impact did their contributions have? These reflections can be powerful tools for personal growth and self-discovery.

A lifelong lesson

Teaching your teenager about the “joy of giving” extends beyond financial education—it’s a lesson in humanity. It teaches them that wealth isn’t just about accumulating possessions; it’s about sharing and making a positive impact on the world.

By nurturing empathy, guiding them to choose causes that matter to them, and involving them in the process of giving, you’re helping your teenager develop a sense of responsibility to the community. This invaluable lesson will stay with them throughout their lives, inspiring them to become compassionate and socially conscious adults.

Conclusion

As parents, we often approach our child’s teenage years with a mix of excitement and apprehension. Yet, our ultimate goal remains constant: to prepare them for independent adulthood and equip them with essential life skills to navigate life’s challenges confidently. Among these skills, teaching teenagers about money holds a pivotal role, offering them the tools to make informed decisions, set goals, and secure their financial future.

Teenagers are akin to apprentices in the realm of adulthood, and it’s our role as parents to provide them with the necessary knowledge. You don’t need to be a financial expert to guide them effectively. It’s about offering them guidance while allowing them to take charge. In this blog, we’ve explored the importance of teaching teens about money, covering crucial concepts and offering practical tips for parents and educators.

The pre-teen years lay the groundwork for financial education, including opening bank accounts, distinguishing between “needs” and “wants,” and nurturing responsible spending habits. These early lessons pave the way for more advanced financial concepts. As teenagers, encourage them to make financial choices independently, learn from their mistakes, and apply concepts such as budgeting, delayed gratification, and discerning needs from wants. Empower them to envision prosperity, earn money through various avenues, and budget effectively, ensuring a significant portion goes to savings. Additionally, educate them on the power of compound interest and investing, emphasizing the importance of starting early. Finally, instill in them the joy of giving by nurturing empathy and generosity through volunteering and charitable activities. By imparting these skills and values, you’re not only preparing your teenager for financial success but also for a well-rounded, compassionate, and confident adulthood.

Leave a Reply