Teach your child to save by

Click on respective technique to learn more

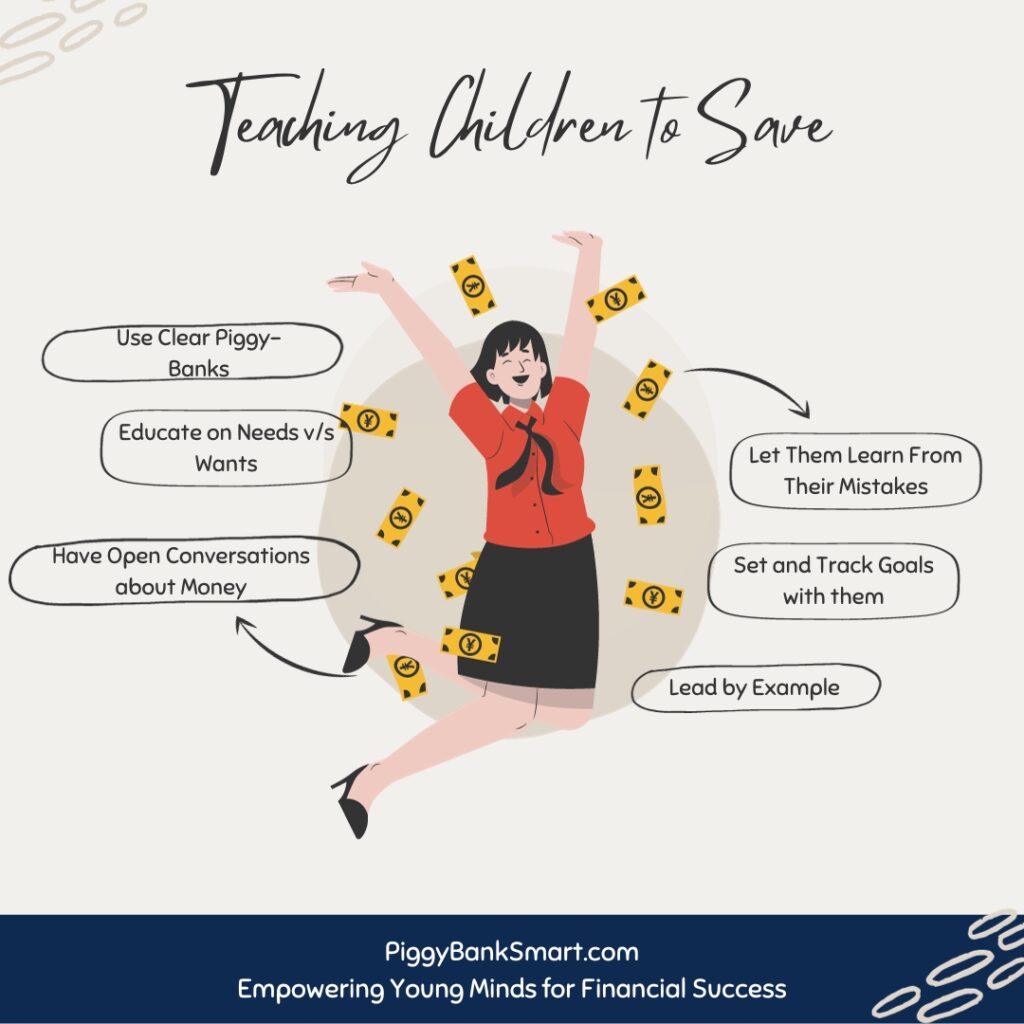

As parents, we possess a valuable opportunity to impart the virtues of financial responsibility to our children. Teaching children to save money at a young age not only paves the way for financial independence but also instills indispensable life skills. In this blog post, we’ll delve into age-appropriate tools such as piggy-banks and conversations about money to nurture financial prudence. Teaching children and having them practice differentiating needs and wants, goal-setting and tracking their spending are effective ways to inculcate the habit of saving at a young age.

Today’s world is a world of choices. This is evident from the fact that 64% of US consumers (166m) were living paycheck to paycheck in December 2022. It is even more surprising that 86% of these consumers earn more than $100,000 annually. This highlights that financial prosperity isn’t solely determined by income; it’s about cultivating healthy money habits, including saving. The foundation for these habits is often laid in childhood. Therefore, teaching children to save is critical.

Teaching Children to Save Through PiggyBanks

When embarking on the journey to teach children about the importance of saving, few tools are as timeless and effective as the trusty Piggy Bank. These humble objects hold the power to impart invaluable financial literacy lessons in importance of saving to kids.

Encourage them to set a goal of filling their piggy bank with money. Explain that the funds they stash away today will serve them in the future, covering the things they truly need. Opting for a clear piggy bank such as this can be particularly insightful for young minds. It provides powerful visualization, allowing them to witness the growth of their savings. This visual progress can serve as a powerful motivator, spurring them to save even more.

For an added lesson in practical finance, consider making periodic contributions to their piggybank, similar to Mr. Kevin O’Leary’s approach. These contributions can be tied to specific savings goals or given on a regular basis. This hands-on experience will illustrate the concept of compound interest, teaching them that money has the potential to make more money. In doing so, you’ll empower them with a real-life understanding of financial principles that will benefit them for a lifetime.

Educate on Needs v/s Wants

The distinction between needs and wants is one of the most important fundamental concepts while teaching children to save.

It’s essential to explain to them that “needs” are the essentials—things vital for our survival. For instance, needs encompass items like food, rent, and utilities, which are necessary for us to live and thrive. On the flip side, “wants” are desires—things that bring us joy but aren’t crucial for our survival. While fulfilling wants can make life more enjoyable, we can still live without them.

It’s crucial to convey that the definition of needs and wants can vary based on individual circumstances. For instance, students living near or on campus might not need a car, whereas others may require one to commute to school or work. Additionally, it’s important to discuss the fine line between needs and wants. For instance, while purchasing a pair of shoes is often a need, indulging in the latest designer pair is a want.

To make learning about needs and wants enjoyable, use real-life examples and scenarios. Involve your children in the decision-making process when you go shopping together. Encourage them to determine whether an item falls into the category of a need or a want. Ask them to explain their reasoning, prompting them to think critically. Furthermore, if they express an interest in buying the latest pair of shoes or any other item, suggest that they take a day to contemplate the purchase. Remind them that the desired item will still be available tomorrow. This provides an opportunity to discuss how spending money on wants might hinder their ability to save for long-term goals.

By teaching children to differentiate between needs and wants and encouraging them to think before making impulse purchases, you’re laying the foundation for sound financial practices that will benefit them throughout their lives.

Teaching Children to Save through Goal-Setting

Setting goals, aspiring and working hard to achieve them is one of the most important life-skills that you can impart to your children. In addition to the real-life implications, the approach also provides an amazing opportunity to teach children to save. Discuss with your child – their aspirations, needs and wishes. Start by having a conversation with your child about their dreams, needs, and wishes. Let them define a savings goal and set a timeline for achieving it. Break the goal into smaller, manageable parts.

Teaching Children to Save through a “Savings Board”

For example, a goal to save $100 within the next four months can be broken down into saving target of $25 each month. Visualize the goal for them. Draw a straight line on a canvas with the starting balance ($0) on the left and the goal ($100) on the right end. Highlight the smaller monthly targets you’ve set.. As time progresses and they start contributing to their savings goal, start highlighting them on the chart. I find colorful sticky notes as a great way to document this on the chart. Encourage your child to document the amount, date and the source of fund to keep track of this. Pasting this sticky on the board is as powerful a motivator as seeing their savings grow. As they achieve small milestones, celebrate it with them. Match their contribution, if possible to encourage further saving.

Harnessing Mistakes as Teaching Experiences

As your child strives to reach their savings goal, it’s valuable to allow them to make minor missteps and glean lessons from them. For instance, if your child is tempted to spend their entire allowance on an unnecessary, fancy pair of shoes, consider letting them go ahead. When they later notice that they haven’t met their monthly savings target, it’s a moment of self-discovery. These small mistakes serve as powerful teaching moments. Through these experiences, they gain valuable insights and skills that will equip them to navigate similar distractions in their adult lives more effectively.

Build a Habit of Tracking Expenses

A crucial aspect of becoming a savvy saver is keeping a close eye on your expenditures. Utilize a mobile app, an Excel spreadsheet, or simply a plain piece of paper to meticulously record your spending. Categorize expenses into “needs” and “wants.” Encourage your child to jot down transactions daily and tally up their expenses on a weekly or bi-weekly basis. This way, they can actively monitor their progress toward their savings goal. Engage in reflective conversations with them about expenses that might have been avoidable.

Lead By Example

Set Gold Standard

Children absorb a lot of knowledge through observation. Their eyes and ears are constantly tuned to your actions and words. When it comes to teaching your child the art of saving, setting the right example is paramount. Show them the way by being a responsible saver yourself.

If you want your child to create a savings board, consider creating one alongside them. For older children, take the initiative to guide them in opening a savings account at a bank. Explain the importance of saving by sharing your own contributions to a registered pension plan like RRSP or 401(k), or by regularly saving in a designated account.

If you want them to track their expenses, show them how you do it. By demonstrating this practice with your own finances, you’ll inspire your child to follow suit with their allowance and expenses.Sharing your own goal-tracking experience and having open discussions as they work towards their target can be truly enlightening for them.

Talk About Money and Finance

A survey of more than 2000 parents by T Rowe. Price in 2022 suggested that 57% of parents avoid discussing about money with their child. To ensure you and your child are well-prepared for the financial journey ahead, it’s crucial not to make this mistake. Engage in open conversations about money, discuss what you’re saving for, and share your saving strategies with them.

Maintain an open-door policy, encouraging your child to approach you whenever they have questions or topics related to money on their mind. Cultivate financial awareness and responsibility within your family by regularly convening budget meetings involving all members. This approach goes beyond teaching children to save; it involves them in broader financial dialogues that significantly influence your family’s financial well-being.

By fostering these discussions, you help your child develop a positive relationship with money. Additionally, it equips them with the skills to make informed and thoughtful financial decisions, allowing them to thoroughly analyze various aspects of a financial choice before committing to it.

Key Takeaways

As parents, we possess a unique opportunity to impart financial responsibility to our children

- Teaching children to save from a young age equips them with essential life skills and sets the foundation for financial independence

- By guiding them through goal-setting, differentiating between needs and wants, and embracing mistakes as learning opportunities, you’re laying a strong financial foundation

- Leading by example and engaging in open discussions about money empower your children to make informed and thoughtful financial decisions

Once your child is good at saving and tracking expenses, may be, it is time for them to graduate to getting a debit or credit card. Before you get them one, read our insight on getting these financial products for children to optimize their financial literacy journey.

Leave a Reply