Money isn’t as abundant as some teenagers believe. They often have more spending desires than their budget allows. One of the primary reasons for this behaviour is that they have yet to fully grasp the true value of money. As children grow into teenagers, teaching about personal finance becomes paramount. This is evident from the fact that 75% of teens lack confidence in their personal finance knowledge. Therefore, it becomes crucial to instill a strong understanding of the value of money in them. Creating money scarcity is one of the most powerful tools to teach the value of money to teenagers. Encouraging them to earn money and budget according to their needs and wants while creating actionable savings goals and plans is essential in teaching these principles to teens.

In this article

Teach the Value of Money to Teenagers by Creating Scarcity

In the hyper-commercialized world of instant gratification, teaching teenagers the true value of money can be challenging. However, one effective strategy is to introduce the concept of scarcity. Our primary goal as parents is to provide our children comfort and support. Nonetheless, it’s crucial to remember that while we can offer them comfort, they must ultimately learn to lead independent lives as adults. Creating scarcity can be a potent tool for teaching the value of money to teenagers. Money is finite. Helping teens understand this empowers them with essential life skills, including decision-making, independence and responsibility.

How to use scarcity to teach the value of money

- Link their allowance to specific household and financial tasks and responsibilities.

- Guide them in establishing savings goals.

- Promote the practice of delaying purchases and seeking bargains.

- Allow them to learn valuable lessons from their mistakes.

Scarcity Encourages Prioritization

When teenagers are made aware of money’s finite nature, they realize that they can’t have everything they want. This, in turn, forces them to make choices and prioritize their spending. They learn to distinguish between needs and wants and allocate their resources accordingly.

Scarcity teaches patience

Scarcity can also teach teenagers the value of patience. When they have to save and wait for something they want, they learn delayed gratification, an essential skill for making sound financial decisions later in life.

Teaching the value of money to teenagers through the concept of scarcity is a valuable life lesson. By introducing financial limitations and encouraging responsible decision-making, you equip them with the knowledge and skills they need to navigate the complex financial world they’ll encounter as adults. Ultimately, creating scarcity in their financial lives empowers teenagers to become financially responsible, independent, and capable individuals.

Encourage Teenagers to Earn Money

The first time I learnt the value of money was when I had to spend five straight nights to finish a deadline for one of my clients from a freelancing gig. Nothing teaches one the true value of money as effectively as the struggle to earn it themselves. The same holds for your teenage child as well. As your teen child transitions from childhood to adulthood, their perception of money evolves.

Benefits of Encouraging Teenagers To Earn Money

Earning money is a powerful ally in teaching teenagers the value of money by:

- Instilling a Sense of Responsibility: Earning money instills a sense of responsibility in your teenagers. When they work for their money, they learn to appreciate it and become more responsible. By earning money, teenagers understand the value of money.

- Building a Strong Work Ethic: Earning money through part-time jobs or side gigs instills a strong work ethic. It helps them understand the effort and dedication required to achieve their financial goals.

- Understanding concepts like tax and deductions: Remember that episode from Friends where Rachel got her first paycheck and was like, “Who the hell is this fica guy, and why is he taking all my money?” While she was all grown up, chances are your teen child may also not know basic concepts like tax, deductions, etc. Earning money empowers teenagers to grasp real-world financial concepts such as taxes, deductions, and the importance of financial planning. By experiencing these financial aspects firsthand, they become better equipped to navigate the complexities of taxation and financial responsibilities, setting the stage for financial literacy in the future.

- Fostering Independence: Encouraging your teens to earn money fosters independence. They become less reliant on you for financial support, allowing them to make choices and take responsibility for their financial well-being. This independence builds their confidence and self-sufficiency, preparing them for the challenges of adulthood.

Ways for Teens to Earn Money:

- Part-Time Jobs: Encourage your teenagers to explore part-time job opportunities in their areas of interest. These experiences can be both financially rewarding and personally fulfilling.

- Side Hustles: In today’s digital age, teens can explore numerous online and offline side hustles, from babysitting, freelancing and tutoring to selling handmade crafts or offering digital services.

- Entrepreneurship: For entrepreneurial-minded teens, starting a small business or pursuing a passion project can be an excellent way to learn valuable financial and business skills.

Teach Budgeting to Teenagers

Building on the principles of the finite nature of money, budgeting is a powerful enabler for teaching the value of money to teenagers. Introducing budgeting to teenagers gives them the tools to make informed financial decisions and set the stage for a successful financial future.

How Budgeting Teaches the Value of Money to Teenagers

- Awareness of Income and Expenses: Budgeting begins with tracking income and expenses. By involving teenagers in this process, they better understand how money flows in and out of their lives.

- Prioritization: When creating a budget, teenagers must prioritize their spending. This teaches them to differentiate between needs (e.g., school expenses) and wants (e.g., entertainment), fostering responsible financial choices.

- Delayed Gratification: Budgeting encourages teenagers to think long-term. They learn the value of saving for future goals and delaying instant gratification, a crucial skill for building financial security.

- Financial Consequences: If teenagers overspend or don’t stick to their budget, they experience real-life financial consequences. This offers valuable lessons and motivates them to stay on track.

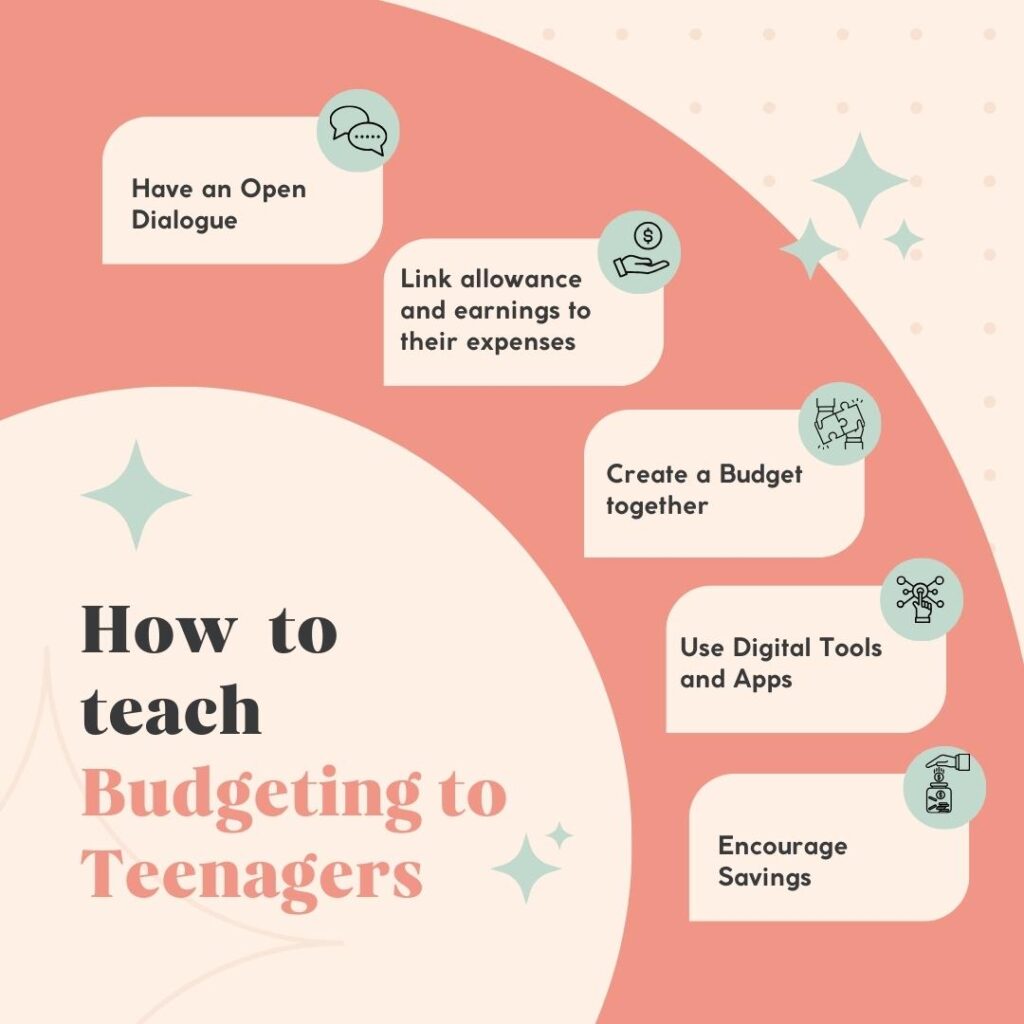

How to Teach Budgeting to Teenagers

- Open Dialogue: Start by having open and honest conversations about money. Discuss your family’s financial goals and challenges, encouraging teenagers to ask questions and share their thoughts.

- Allowance and Income: Link their allowance to responsibilities, such as chores. For teenagers with part-time jobs, help them set up a budget using their income as the primary source.

- Create a Budget Together: Sit down with your teenagers and create a budget. Discuss their financial goals and help them allocate money for various purposes, including savings and spending.

- Use Digital Tools: There are many budgeting apps and tools, such as the one available here, designed for teenagers, that can make the process more engaging and convenient.

- Encourage Savings: Motivate your teenagers to save a portion of their income. Setting savings goals, like an emergency fund or a special purchase, can make saving more exciting.

Conclusion

In a world marked by consumerism and instant gratification, instilling the value of money in teenagers is a crucial responsibility. Creating scarcity, encouraging them to earn money, and teaching them to budget are powerful tools for imparting this essential life lesson.

Scarcity forces teenagers to prioritize and delay gratification, giving them a deeper understanding of the finite nature of money. It prepares them to make smart choices and be financially responsible in the future.

Earning money provides teenagers with a firsthand experience of the effort and dedication required to earn and manage their finances. It equips them with invaluable skills in responsibility, work ethic, and financial literacy.

Budgeting empowers teenagers with the tools to manage their income, prioritize spending, and plan for the future. It teaches them to differentiate between needs and wants, fostering disciplined decision-making.

By introducing these concepts and tools, we pave the way for teenagers to become financially responsible, independent, and capable individuals. We equip them with essential life skills to guide them toward a secure and prosperous financial future. Embrace the opportunity to teach your teenagers these valuable lessons, and you’ll be helping them build a solid foundation for their financial journeys.

Feel free to share your strategies for teaching the value of money to your teenage child in the comments below. If you’re considering introducing them to credit or debit cards, check out the checklist here to ensure they make the most of using plastic money.

Leave a Reply